Bankers Association of Malawi (BAM) says customers’ access to cash is being hampered by network issues and electricity outages experienced since Tropical Storm Ana hit the country in January this year.

BAM chief executive officer Lyness Nkungula said in an interview with Business News this has led to extra costs for the banks because they often have to rely on alternative sources of energy.

She said: “These two are interconnected such that when electricity is not available, network is also not available, thereby affecting access. This has led to extra costs for the banks because banks often have to rely on alternative sources of energy in this case generators and then the cost of fuel is not cheap at all.

“Banks have to make sure that customers are served at all times and the systems are supposed to be running 24/7. We hope this problem will be over soon.”

The country has been facing electricity challenges following the drop in generation capacity to around 312 megawatts (MW)due to the breakdown of Kapichira Hydro Power Station with a capacity of 129.6 MW.

The damage followed the flooding of the Shire River due to Tropical Storm Ana, a situation that forced Energy Generation Company to shut down the station.

Speaking during a media engagement dinner on Thursday, National Bank of Malawi plc head of digital banking services William Kaunda said while the power outages have disrupted the bank’s network, it has lined up a number of initiatives to improve digital uptake, which stand at over 90 percent.

He said: “The blackouts we are facing, which we were not experiencing in the past two years, have brought network challenges. We are hopeful that with a stable supply of electricity, we will get a stable network system.”

Kaunda said among other initiatives, the bank will soon be launching the mo626pay App to accept digital payments using a quick response or QR Code.

Speaking separately, Consumers Associatiation of Malawi executive director John Kapito said the power outages have frustrated consumers that access online and physical banking services.

He said: “We are requesting the banking sector to begin identifying other sources of power.

“They need to be innovative to ensure they maintain their consumer base and bring confidence to consumers as they are losing faith in the financial platforms.”

Reserve Bank of Malawi (RBM) figures show that although retail digital financial services transactions contribute 99.1 percent of the overall volume of transactions, they account for just 9.6 percent of the total value of transactions processed, reflecting the fact that digital financial services are mostly low value, but voluminous in nature.

In 2021, for instance, the volume and value of transactions rose by 62.8 percent and 39.9 percent to 765.4 million and K9.7 trillion, respectively.

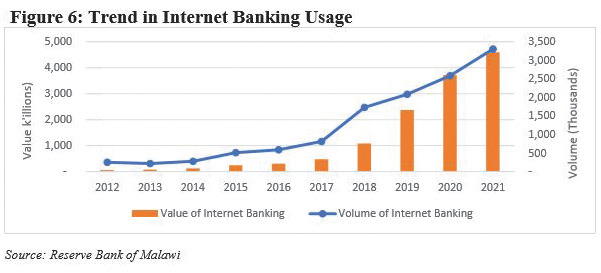

Both the volume and value of transactions on Internet banking platforms increased by 27.8 percent and 23.6 percent to 3.3 million and K4.6 trillion, respectively, during the same period.

On average, each Internet banking transaction had a value of K1.4 million during the period under review.

This is much higher than the average transaction values of point of sale at K37 328.56, mobile banking at K30 738.78 and mobile money services at K5 554.87, which in essence reflect significant use of the service by corporate institutions.

ICT Association of Malawi president Bram Fudzulani observed that there is need for mindset change initiatives to improve digital uptake.

“We need sensitisation programmes to incorporate cyber security so that Malawians are aware of basic use of digital financial services,” he said.

Sources: The Nation_Wednesday, April 6, 2022_by Grace Phiri